By: Zoocasa

Are you interested in buying a home in Toronto? If so, you’ll need to be among the top bracket of income earners, according to a recent report by Zoocasa.

The report states that only the top 10% of income earners can afford to purchase a house in Toronto, at a benchmark price of $873,100. This means that someone would have to obtain an income of $124,554 in order to afford a home of this price.

Toronto is one of the most expensive places to live in all of Canada, second only to Vancouver. To buy a house there, residents are required to have an income of $205,475, which is among the top 2.5% of income earners. Homes are out of reach for nearly everyone residing in this coastal seaport city. These dramatic real estate prices can be attributed to the ever-increasing population densities in both Vancouver and Toronto.

A Look at Home Prices and Incomes

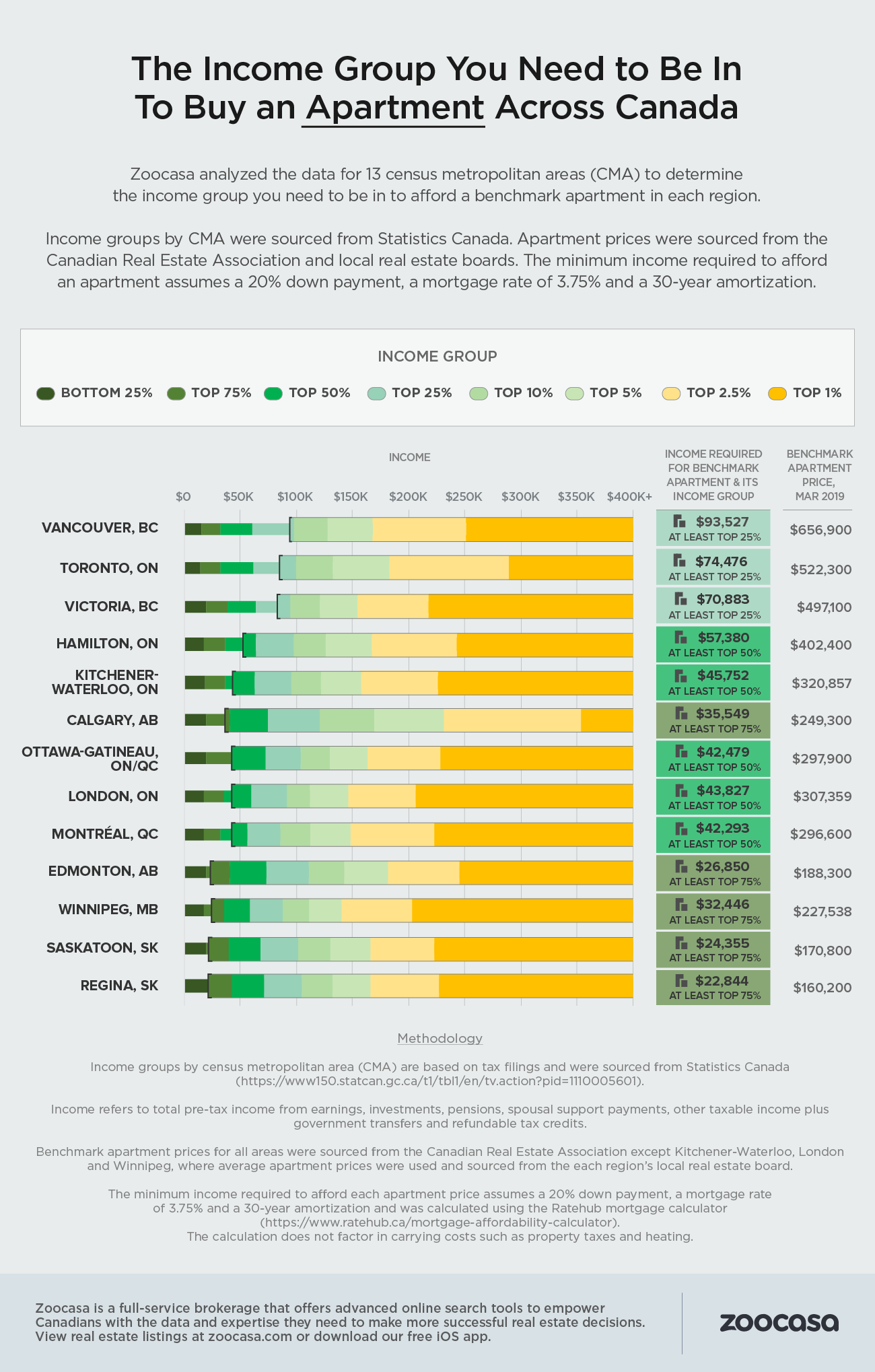

The Zoocasa study, which identified the income that home buyers would need to afford the benchmark home in Toronto, assumed a 20% down payment, 3.75% mortgage rate, and a 30-year amortization. The affordability findings were then cross-referenced with income tax filings as reported by Statistics Canada to determine which income classification buyers have to be among in order to afford local real estate. Home price data was sourced from the Canadian Real Estate Association and local real estate boards.

Apartments Unattainable for Many

While it might not be shocking that houses are limited to the top earners, the data shows that even entry-level housing, like condo apartments, are unattainable by many in Toronto. The numbers indicate that those looking to purchase apartments in Toronto need to be within the top 25% of income earners, making at least $74,476 per year.

Alternative Housing Markets

Though the housing market in Toronto may seem like an unattainable ideal, there are other markets in Ontario and Canada that offer more affordable options for prospective buyers. Many Ontario markets and wider Canadian markets offer the best of both worlds in terms of housing affordability and location. For example, Calgary condos, Hamilton condos, and condos for sale in Ottawa offer some attractive and affordable listings while providing residents with the added bonus of similar amenities and economic opportunities that markets like Toronto offer.

Additionally, with rapidly improving transportation infrastructure, it is becoming easier to commute to places like Toronto, removing the need to actually reside in the area. Considering other locations for real estate may be a worthwhile endeavour for those partaking in home searches.

Want to learn more about different housing markets and income requirements? Check out these infographics by Zoocasa below.